About This Course

CFA full form is Chartered Financial Analyst. CFA is one of the most sought-after designations for investment professionals across the globe. CFA Institute offers a globally recognised professional credential in Financial Management & investment. The CFA course is regarded as the world’s most respected and recognised designation in finance and investment management. Candidates pursuing the course gain insights into the finance and investment industry to add value to their skills. This in turn leads to an increase in the probability of landing a high-paying job in the field of finance and investment management. With the boom in industrialisation and globalisation, India has been encountering a surge in the jobs for CFAs. Candidates who qualify for the exam for all three-course levels mentioned below will be awarded the charter holder designation by the CFA Institute:

CFA Eligibility Criteria

The CFA aspirants have to meet the following CFA requirements or eligibility criteria in order to qualify for the course.

⦁ The candidates must pass their bachelor’s or equivalent programs from any stream from recognized universities or colleges.

⦁ Candidates who are in the last year of their Bachelor’s degree program can also register for the CFA course. However, candidates must complete their Bachelor’s course prior to the date of registering for ⦁ CFA level 2 exam.

⦁ Candidates must have a minimum work experience of 4000 Hours or a combination of 4000 hours of work experience or higher education acquired over a minimum period of 3 sequential years before registering for the level 1 exam.

⦁ An Interesting CFA Requirement is that those who are doing internships or articleship or have their own business will also be counted as work experience, on the basis you are able to show that you are paid for this.

⦁ The work experience need not be in the field of investment market but the candidates must demonstrate the following skills Leadership and teamwork, Business communications, Critical thinking and problem solving, time management, professional judgment, analytical skills and adaptability

⦁ Another CFA requirement is that the candidates must have an international passport.

⦁ One of the most important requirements for Chartered Financial Analyst is that the candidates must be fluent in English as the study material, as well as the exams, would be conducted in English

⦁ Candidates are also required to submit a professional compliance statement

CFA Syllabus

The entire CFA course has been divided into three levels. The levels are CFA Level 1, CFA Level 2 and CFA Level 3. CFA level 1 Syllabus mainly constitutes of basic concepts of the academic disciplines of Finance and Investment. The candidates can only move to the next level after passing the previous level exam. The curriculum is designed in such a way that the candidates gain in-depth knowledge in investment depth, investment decision making, financial accounting, derivatives, stock market, etc.

CFA Level 1 Syllabus

The general CFA syllabus includes the following subjects such as :

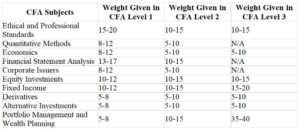

CFA Subjects

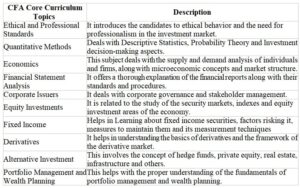

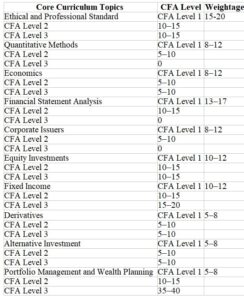

The Course content of the different levels of the CFA Exam namely, CFA Level 1, CFA Level 2 and CFA Level 3 revolve around 10 core curriculum topics. Although the CFA course syllabus involves almost the same subjects in each level of exam, the difficulty level of the exam is increased with the levels of the exam.

The core curriculum topics have been tabulated below.

CFA Course: Level wise weightage

As stated the courses remain the same throughout the entire curriculum of CFA Certification course. However, the weightage of the core curriculum varies according to the level of CFA course.

CFA Course Exam

The CFA exam for the different levels is held around the entire year. The weightage of the course curriculum varies according to the different levels of the exam. The passing rate of the different levels is comparatively less as it hovers between 40-50%.

CFA Level 1

The CFA Level 1 exam has been changed to computer-based from paper-based format. This exam will be conducted in February, March, May, July, August, and November.

CFA exams are now held across India with limited capacity and added restrictions. Aspirants who have missed the November exam due to the ongoing pandemic can opt for the Online Proctored Test (OPT) offered by the CFA Institute. Additional data regarding OPT will be provided to the candidates via email.

CFA Level 1: Registration Process

⦁ First, candidates should create an account on the CFA Institute website, and give the necessary appropriate information and select their preferred exam center.

⦁ If the candidates are eligible and wish to apply for any scholarship, they must register as early as possible and submit their scholarship application.

⦁ If candidates are not awarded any scholarship, then the next step would be to pay their application and exam fee which can be done through credit card, wire transfer, etc., and the amount depends upon the time of registration by the candidates.

⦁ There are 3 registration fee deadlines; the first one is the cheapest and the last one is the costliest.

⦁ If candidates are registering for CFA Level 1 for the first time, then they are required to pay an additional one-time enrollment fee of USD 450.

⦁ During registration, candidates should read and accept the Candidate Agreement.

⦁ Candidates must also submit the Professional Conduct Statement (disclosing relevant reprimands, litigations, Investigations etc.) upon the first CFA exam registration and then annually and before every next exam registration.

⦁ The results are declared after 60 days from the date of the exam.

CFA Level 1: Exam Pattern

The following are the CFA Level 1 Exam pattern and guidelines.

⦁ The entire exam would be divided into two half each of a time period of 2 hours 15 minutes.

⦁ There would be 90 MCQ questions for each half.

⦁ The first session would cover topics such as ethics & professional standards, quantitative methods, economics, and financial reporting and analysis.

⦁ The second session includes questions about corporate finance, equity, fixed income, derivatives, alternative investments and portfolio management

⦁ Candidates get an average of 90 seconds to answer a particular question in the level 1 exam.

⦁ It has been observed that the candidates must spend 303 hours a year to pass the CFA level 1 exam

CFA Level 1 Exam Dates

| Exam Period | Dates |

| February Period | 14–20 February 2023 |

| May Period | 16–22 May 2023 |

| August Period | 22 – 28 August 2023 |

| November Period | 11 – 17 November 2023 |

CFA Level 2

The CFA Level 2 exam is designed to evaluate a candidate’s capability in the application of investment valuation concepts. In the CFA Level 2 examination, candidates will come across 10 topics that have been grouped into four areas which are: Investment Tools, Ethical and Professional Standards, Portfolio Management and wealth planning. The total duration of the level 2 exam is 4.5 hours.

CFA Level 2: Registration Process

- The process is almost the same for CFA Level 2, as it was for CFA Level 1.

- The eligible candidates can apply for the scholarship programs. If not, then the candidates are required to submit the exam fee payment before the deadline after selecting the exam center. There will be no enrollment fee this time.

- Candidates must read and accept the Candidate Agreement and submit a Professional Conduct Statement, as done for Level 1.

- The results are declared after 60 days from the date of the exam.

CFA Level 2: Exam Pattern

The following are the exam pattern and the guidelines that the candidates must follow for the level 2 exam

- The duration of the CFA level 2 exam is for a period of 4.5 Hours.

- The exam is divided into two halves each of a duration of 135 minutes with an optional break in between.

- There are a total of 88 Vignette-supported Multiple choice questions. Thus there would be 44 questions in each session

- There would be 4-6 MCQs after each Vignette. Each MCQ is awarded 3 points for each correct answer.

- It focuses on the valuation of various assets and emphasizes the application of investment tools and concepts in contextual situations.

- The average passing rate is 45%.

- The candidates need to put in 27 hours per month and overall 328 hours a year to pass the level 2 exam.

CFA Level 2 Exam Dates

| Exam Period | Dates |

| May Period | 23–27 May 2023 |

| August Period | 29 August – 2 September 2023 |

| November Period | 18 – 22 November 2023 |

CFA Level 3

CFA Level 3 exam is the final level after which candidates can be certified as Chartered Financial Analysts. The CFA Level 3 exam focuses on wealth planning and portfolio management. CFA level 3 exam is graded for 360 points, which stands to one point per minute. The duration of the level 3 exam is 4.5 hours, which is divided into two sessions.

CFA Level 3: Registration Process

- To register for CFA Level 3 exam, candidates are required to fill it’s the registration form online on the official website of the CFA Institute with the necessary details and select the preferred exam center.

- The next step would be to select suitable eligibility criteria from the given options. Candidates are required to fill in the details of their profession, employer, employer location or education level.

- Read the Candidate Agreement and accept it after properly reading it.

- Candidates are required to select the format of the CFA study material they wish to get.

- Candidates must fill in the fees via credit card, wire transfer and other payment methods.

CFA Level 3: Exam Pattern

The following are the details and guidelines of the CFA Level 3 exam:

- The entire duration of the CFA Level 3 exam is for a period of 4.5 hours with each session divided into a period of 2 hours 15 minutes.

- There will be a total of 8-11 Vignettes followed by MCQs in the second session. The total number of MCQs for the Level 3 exam is 44.

- There are also essay-type questions that have varying points accredited to them.

- The candidates have to type the answers in the text box.

- The MCQs will have 3 or more choices.

- It focuses on effective wealth planning and portfolio management by requiring the candidate to synthesize all the concepts and analytical methods in the entire curriculum.

- The candidates are required to put in about 344 Hours a year to pass the level 3 exam.

- The average passing rate was 54%.

CFA Level 3 Exam Dates

| Exam Period | Dates |

| February Period | 21–23 February 2023 |

| August Period | 29 August – 5 September 2023 |

CFA Course Job Profile

After the completion of the CFA certification course, a Chartered Financial Analyst can get employed in the following positions such as Business Consultant, Investment Manager, Private Bankers, CFO and Many more. The candidates can get an average salary of INR 8,00,000-INR 20,00,000.

Let us discuss the CFA salary in India for the different job profiles

| Job Profile | Job description |

| Chartered Financial Analyst | The Chartered Financial Analysts are tasked with making the financial decision of the company regarding investment management , track stock performances, etc. They have to research and track the financial position of the different companies as well as individuals. |

| Business Consultant | The business consultants are concerned with the different aspects of the business such as the finance ,accounting, marketing, operation, etc.They are concerned with the overall operation and effectiveness of the business |

| Market Research Analyst | They collect data from the market from the customers, competitors, etc. They take stock of the entire market conditions and provide the company’s top brass information about the next course of action. |

| Investment Manager | The main job role of the investment manager is to provide the companies or individual clients with advice regarding the various investment options such as buying or selling of bonds, mutual funds, securities and stock. |

| Portfolio Manager | Their main role is to create and manage the investment portfolio of different clients. They try to understand the trend in the market and maximise the clients’ return in investment. |

| Private Bankers | They help their individual clients to maintain their individual account and financial risks and services. They also sell various financial services of the bank to the individual clients |

| Risk Manager | They identify the financial risk that the organisation may face in the future and try to find a solution so that they are able to mitigate the risk. They also check the financial risk of new business ventures |

| CFO | CFO manages all the financial resources of the organisation and assesses the risk and opportunities of different ventures. They collaborate with the different subordinates to make the best decision for the company |

At AP Academy we want you to succeed in your qualification, and will support you every step of the way, but we need you to put in the effort too. Practice makes perfect, so make sure to leave as much time as possible for exam preparation and practice questions.

-

CFA LEVEL 1

apacademycourse

Agile Project Expert