About This Course

Eligibility criteria –

⦁ A candidate passed/appearing in the Senior Secondary (10+2) Examination or equivalent thereto is eligible to appear in the CSEET.

⦁ All Graduates/Post Graduates who were hitherto eligible for registration directly to CS Executive Programme, are also required to pass the CSEET to become eligible for registration to the Executive Programme.

⦁ Candidates who have passed the CS Foundation Programme are exempted from CSEET without any payment of exemption fee.

⦁ Candidates who have passed the Final Examination of The Institute of Chartered Accountants of India (ICAI) and/or The Institute of Cost Accountants of India (ICMAI) are exempted from CSEET and shall pay `5,000 (Rupees Five Thousand Only) towards exemption fee at the time of Registration to CS Executive Programme.

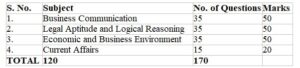

CSEET Exam Pattern –

⦁ The Institute will conduct CS Executive Entrance Test based on Objective Type / Multiple Choice Questions and viva-voce for testing listening, written communication and oral communication skills.

⦁ There are four papers in CS Executive Entrance Test.

⦁ Each paper contains objective type multiple choice questions having one or more marks each with four options with one correct answer.

⦁ The duration of the Test shall be 120 minutes and viva-voce on Presentation and Communication Skills of 15 Minutes.

CSEET Exam Duration –

COMPUTER BASED TEST (CBT): Test of 120 Minutes duration will be conducted at designated Test Centres. It will be a Computer Based Test (CBT) conducted in MCQ pattern as per the following details:

VIVA-VOCE: The Presentation and Communication Skills (Viva Voce) of 15 Minutes for 30 Marks will be conducted simultaneously with or immediately after the MCQ based CBT through online mode using artificial intelligence (AI) or through recoded videos at the designated Test Centres. FINAL SCORE: The final score will be computed by adding the marks secured by candidates in both the Tests (CBT and Viva-Voce) out of a total of 200 marks.

CSEET Passing Criteria –

Candidates shall be declared ‘PASS’ in CSEET on securing 40% marks in each paper and 50% marks in the aggregate.

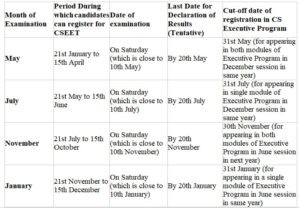

Schedule and Conduct of CSEET

Executive Programme Eligibility

- Now CSEET will be a mandatory qualifying test for all categories of students for registration to the Executive Programme except a few exempted categories.

- The candidate’s age must not be less than 17 years on the date of application

- To be eligible for CSEET, candidates must have completed Class 12

- Graduate/Post Graduate candidates who were eligible to seek registration directly to the Executive Programme will also have to qualify CSEET to become eligible for registration to Executive Programme.

The following categories of students are exempted from qualifying CSEET and can seek registration directly to the Executive Programme:

| CS Foundation Programme passed students | Exemption Fee: Nil |

| ICAI (The Institute of Chartered Accountants of India) final course passed students | Exemption Fee: Rs 5000 |

| ICMAI (The Institute of Cost Accountants of India) final course passed students |

Exemption Fee: Rs 5000 |

Qualifying Cut off

Candidates need to secure an aggregate of 50% and a minimum of 40% in each subject in CSEET.

CS Executive Exam Pattern

| Exam Highlights | Details |

| Mode of exam | Pen paper-based exam |

| Medium of exam | English |

| Duration of exam | Three hours (180 minutes) |

| Number of questions each subject | For Objective papers- 100 MCQ each paper For Subjective papers- Total 6 questions each divided into 4 parts |

| Total number of papers | Total two modules (4 papers in each module) |

| Types of questions | Both objective and subjective |

| Exam conducting body | Institute of Company Secretaries of India (ICSI) |

| Frequency | Twice in a year |

| Marking scheme | 100 marks on each paper |

| Negative marking | negative marking of – 0.25 mark for every wrong answer |

| Paper | Subject | Marks |

| Paper- 1 (subjective questions) | Jurisprudence, Interpretation and General Laws (Module -I) | Total 100 marks |

| Paper- 2 (subjective questions) | Securities Laws and Capital Markets (Module – II) | Total 100 marks |

| Paper- 3 (subjective questions) | Company Law (Module- I) | Total 100 marks |

| Paper- 4 (subjective questions) | Economic, Business and Commercial Laws (Module- II) | Total 100 marks |

| Paper- 5 (subjective questions) | Setting up of Business Entities and Closure (Module- I) | Total 100 marks |

| Paper- 6 (objective questions) | Corporate and Management Accounting (Module- I) | Total 100 marks |

| Paper- 7 (objective questions) | Tax Laws (Module- I) | Total 100 marks |

| Paper- 8 (objective questions) | Financial and Strategic Management (Module- II) | Total 100 marks |

Qualifying cutoff:

For all Modules:

- A candidate will be declared passed if he/she secures in one sitting a minimum of 40 per cent in each of the papers and 40 per cent in aggregate of all the papers.

- A candidate will be declared passed is he/she has passed any one or more modules of Professional examination under old syllabus and secures in one sitting at least 40% marks in each of the remaining papers and 50% marks in aggregate.

For one Module:

- The candidate is required to secure a minimum of 40% marks in each of the papers and 50% per cent marks in aggregate, which will be declared ‘pass’ in the Professional Programme.

- If a candidate who has failed in one subject, but got a minimum of 60% of the total marks of the remaining subjects of the module, shall be declared ‘pass’ if he/she secures a minimum of 50% interest.

CS PROFESSIONAL LEVEL

Professional Programme is the final level in Company Secretaryship. Candidates who have cleared their CSEET and Executive Programmes are eligible to undertake Professional Programme.

Eligibility:

The candidate is supposed to register for the Professional Programme nine months prior to the month in which the examination commences to be able to be admitted to the programme.

A candidate registered six months prior to the examination month may be allowed to appear in any one or two module(s) of the Professional Programme.

The candidate must have undergone postal or oral tuition for the modules in which he/she intends to appear in the examination.

Here’s an overview:

| Candidate enrolled in | Eligible to appear in |

| June/July/August | All modules of Professional Programmes Examination to be held in June next year. |

| September/October/November | Anyone or two modules of Professional Programme Examination to be held in June next year. |

| December/January/February | All modules of Professional Programme Examination to be held in December. |

| March/April/May | Anyone or two modules of Professional Programme Examination to be held in December. |

Professional Programme (NEW SYLLABUS)

MODULE 1

- 1. Governance, Risk Management, Compliances And Ethics

- 2. Advanced Tax Laws

- 3. Drafting, Pleadings And Appearances

MODULE 2

- 4. Secretarial Audit, Compliance Management & Due Diligence

- 5. Corporate Restructuring, Insolvency, Liquidation & Winding-up

- 6. Resolution of Corporate Disputes, Non Compliances & Remedies

MODULE 3

- 7. Corporate Funding & Listings In Stock Exchanges

- 8. Multidisciplinary Case Studies

- 9. Electives 1 Out Of Below 8 Subjects (The Examination For This Paper Will Be Open Book Examination)

- 9.1. Banking Law And Practice

- 9.2. Insurance Law And Practice

- 9.3. Intellectual Property Rights– Laws And Practices

- 9.4. Forensic Audit

- 9.5. Direct Tax Law & Practice

- 9.6 Labour Laws & Practice

- 9.7 Valuations & Business Modeling

- 9.8 Insolvency – Law And Practice

CAREER AS COMPANY SECRETARY

| CAREER AS A COMPANY SECRETARY |

| The Institute of Company Secretaries of India (ICSI) |

The Company Secretary is:

|

| Role of a Company Secretary |

| A Company Secretary being multidisciplinary professional renders services in the following areas: |

Corporate Governance and Secretarial Services

|

Corporate Laws Advisory and Representation Services

|

Financial Market Services

|

Management Services

|

| EMPLOYMENT PROSPECTS |

| A qualified Company Secretary has openings in Employment and as Practising Independent Professional

Company Secretary in Employment

Company Secretary in Practice Some of the important areas of recognition for Company Secretary in Practice include:

|

Company Secretaries in Practice also render services in the following areas:

|

At AP Academy we want you to succeed in your qualification, and will support you every step of the way, but we need you to put in the effort too. Practice makes perfect, so make sure to leave as much time as possible for exam preparation and practice questions.

-

CSEET DETAILS

apacademycourse

Agile Project Expert