About This Course

CPA Full Form is a Certified Public Accountant that deals providing certificates to determine the highest level of competency in Accountancy. The CPA Exam is conducted by the American Institute of Certified Public Accountants (AICPA).“Every CPA is an accountant but every accountant is not a CPA.” Stands for Certified Public Accountant, a CPA is a certified and designated financial advisor in various countries in the English-speaking world. The most prominent of all the careers for a CPA include Public Accounting and Industry Accounting. Both are responsible for helping the organization reach its financial goals through performing a number of roles and responsibilities like Auditing and Review, Financial Planning and Business Valuation, Tax Preparation, Company Management, Litigation Services, and Forensic Accounting Services. Thus, individuals with a knack for Accounting and Finance can opt for a CPA course that includes education, a CPA exam, and experience.

CPA ELIGIBILITY

The following are some guidelines candidates need to follow to get CPA certification in India:

⦁ A master’s degree in commerce, accounting, or finance.

⦁ To appear for US CPA tests, an aspirant requires 120 credits.

⦁ To acquire a US CPA license the candidate should have at least 150 credits.

⦁ One year of university education in India is equivalent to 30 credits in the United States.

⦁ In some circumstances, first-year graduates of NAAC-A certified Indian universities can also appear for the US CPA exams.

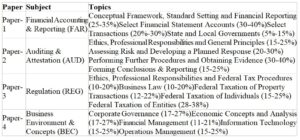

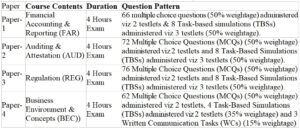

CPA Syllabus

The syllabus of CPA in India is provided in the table below:

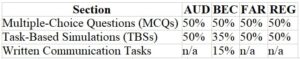

CPA Exam structure

The CPA exam consists of three parts classified as test lets: MCQ, task-based, and written communication. Task-based simulations have gained importance in recent years. MC questions are equally weighted in simulations, except for BEC. MCQs are worth 50% of points and simulations are worth the remaining 50%. AICPA also divides the grade weights between each topic/section under these tests.

Cost of CPA Course in India

⦁ Application Fee: The application fee differs in every state. The fee of the CPA exam is Rs. 3600- 14,500 approximately.

⦁ Examination Fee: The CPA examination fee for each section is approximately Rs. 14,100.

⦁ Registration Fee: The fee is charged as per the state or depends upon the number of sections chosen by the candidates. For example, if you pick four sections at a time, then you should pay approximately Rs 12900

⦁ Ethics Fees for the CPA exam: To attain an ethics license, you should clear the ethics exam according to your state. The ethics fee ranges approximately 10900 to 14500

⦁ CPA Licensing Fees: Upon completing the ethics exam, candidates are considered eligible to receive the CPA license. This fee needs to be paid every year and is approximately $ 50 to 500 per year and may vary from state to state.

⦁ Systematic Professional Education for CPA: These fees is approximately $ 800 and increases up to $5000.

Job Opportunities after CPA Certification in India

Candidates after getting CPA certification in India can apply for the following job opportunities:

⦁ Internal Audit Director

⦁ Tax Manager

⦁ Vice President, Finance

⦁ Financial Controller

⦁ Chief Accountant

⦁ Finance Manager

⦁ Finance Director

⦁ Chief Financial Officer

⦁ Chief Executive Officer

⦁ Chief Audit Executive

⦁ Commercial Director

Roles and Responsibilities of CPA

The primary roles and responsibilities of a CPA in India are:

⦁ CPA’s perform tasks such as book-keeping (Physical or technical), financial planning, advising, preparing government audits, recording of taxes, financial policies etc.

⦁ CPA’swork is to maintain the transaction history of the company.

⦁ They keep a check on the organization’s budget and financial management.

⦁ They suggest effective methods to save the capital of the firm.

⦁ To organize and audit transaction reports.

⦁ To implement monetary benefits.

⦁ CPA’s are also involved in the construction as well as nalysis of budgets

⦁ CPA’s are responsible for updating and applying with the firm new financial methods.

⦁ To update the management of tax consequences of business judgement.

⦁ CPA’s are involved in rectifying the errors, fluctuations caused by monetary activities and money and solving fraudulent activities.

⦁ They handle tax-related activities such as maintaining tax records, tax collection and on-time tax deposits.

⦁ CPA’s analyze ledgers and estimate the revenue

⦁ CPA’s also prepare the company balance sheet

⦁ They act as an advisory for asset safety, company benefits as well as compensations

CPA salary in India

With an increase in organizations, the requirement for CPAs has also increased. Since , their requirement has increased they are paid well. The minimum salary for a CPA is Rs 7.6 lakh per annum.

At AP Academy we want you to succeed in your qualification, and will support you every step of the way, but we need you to put in the effort too. Practice makes perfect, so make sure to leave as much time as possible for exam preparation and practice questions.

apacademycourse

Agile Project Expert