About This Course

ACCA stands for the Association of Chartered Certified Accountants. It is a professional accounting qualification that is recognized and respected globally.

The ACCA course is a program of study that covers various topics in accounting and finance, including financial reporting, management accounting, auditing, and tax.

The ACCA course typically includes a combination of self-study and classroom instruction and culminates in a series of exams that must be passed to earn the ACCA designation.

ACCA is the global CA. A UK based programme which gives you the liberty to practice accounting in India as well as overseas.

It is recognized in Canada, Singapore, UAE and over 180 countries. Industry giants like The Big4, Credit Suisse, Goldman Sachs and many more are actively hiring ACCAs because of their commendable skill sets.

Upon completion, students can work in various fields such as accounting, audit, tax, consulting, and financial management..

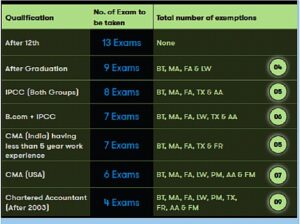

Eligibility

Minimum eligibility criteria for the program

To be eligible to register for ACCA qualification, students should have qualified their 10+2 examinations with an aggregate of 65% in Mathematics / Accounts and English, and a minimum of 50% in other subjects.

Students who have just cleared their class 10 examinations, or do not qualify as per the aforementioned criteria, can still register for the ACCA qualification via Foundation in Accountancy (FIA) route

ACCA Syllabus

APPLIED KNOWLEDGE LEVEL

The Applied Knowledge level exams provide students with a broad introduction to the world of finance and develop their essential understanding and techniques in accounting.

The Applied Knowledge level ACCA exams are:

1) Business and Technology (BT)

2) Financial Accounting (FA)

3) Management Accounting (MA)

Applied Knowledge Level (3 Papers)

ACCA Knowledge Level is divided into 3 papers known as BT, MA and FA

BT: Business Technology

• Business stakeholders and external environment

• Business structure

• Accounting and reporting systems, controls and compliance

• Leadership and teamwork

• Personal effectiveness and communication

• Ethics in accounting and business

MA: Management Accounting

• Management information

• Cost accounting techniques

• Budgeting

• Standard costing

• Performance measurement

FA: Financial Accounting

• Financial reporting

• Qualitative characteristics of financial information

• Double-entry and accounting systems

• Recording transactions

• Trial balance

• Preparing basic financial statements

• Preparing simple consolidated financial

• Statements

• Interpreting financial statements

APPLIED SKILLS LEVEL

These exams are:

4) Corporate and Business Law (LW)

5) Performance Management (PM)

6) Taxation (TX)

7) Financial Reporting (FR)

8) Audit and Assurance (AA)

9) Financial Management (FM)

STRATEGIC PROFESSIONAL LEVEL

Mandatory subjects

10) Strategic Business Reporting (SBR)

11) Strategic Business Leader (SBL)

Optional subjects (students will have to write any two of the below)

⦁ Advanced Financial Management (AFM)

⦁ Advanced Audit and Assurance (AAA)

⦁ Advanced Taxation (ATX)

⦁ Advanced Performance Management (APM)

APPLY FOR EXAMS

Exam Format:

There are 3 papers in Knowledge Level namely, BT, MA and FA.

BT-FA: Each of these papers have 50 objective questions.

Duration:

Each subject exam is 120 minutes long.

Total Marks for Each Subject: 100 Marks

Passing Marks for Each Subject: 50 Marks

The Knowledge Level exams are on-demand exams that can be appeared at any time in the 365 days of the year. The Skill and Professional Level exams are conducted every March, June, September and December.

Note: Maximum of 8 subjects to write in a year.

ACCA COURSE JOB PROFILE

There are multiple ACCA career opportunities available worldwide. Apart from an accountant, an ACCA professional can work as a management consultant, financial planner, and so on. ACCA as a course covers aspects of Chartered Accountancy such as Accounting, Financial Reporting, Auditing, Taxation, Business Finance and Financial Management.

ACCA Course Salary Offered

ACCA salary in India is considerably equivalent to that of a CA professional. An individual with ACCA qualification can earn an average salary of up to INR 8 lakhs p.a. The pay scale generally ranges between INR 5 lakhs p.a. To INR 15 lakhs p.a. It could go higher too, depending upon candidate’s skills, company’s demands, competition, etc. With the increasing time, candidates’ salary increases depending on the experience and knowledge gained by the candidates.

At AP Academy we want you to succeed in your qualification, and will support you every step of the way, but we need you to put in the effort too. Practice makes perfect, so make sure to leave as much time as possible for exam preparation and practice questions.

-

ACCA KNOWLEDGE LEVEL

apacademycourse

Agile Project Expert